Riley: Providence Debt is Epic Disaster, Other RI Towns Even Worse

Tuesday, January 14, 2014

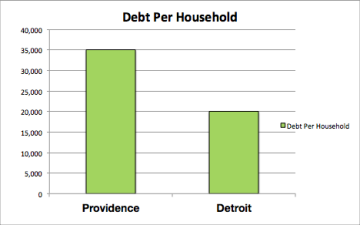

Even after reforms, Providence is still saddled with an enormous debt burden that currently, according to my research, obligates each household to $35,000 in pension and benefit debt. That number compares to debt burden of $20,000 per household in Detroit. Recent reforms negotiated by the Providence City Council and Mayor Angel Taveras did not come easily and have only marginally helped the financial picture in Providence.

The problem is officials didn’t provide an accurate picture before the reforms. An accurate accounting shows, that debt obligations will soon lead to higher taxes and layoffs and reduced services. Unfortunately, the commercial property tax rate is already the highest in the country, exceeding that of bankrupt Detroit. Mayor Taveras has appropriately declared a freeze on commercial taxes.

Critical status

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLASTProvidence’s council and the mayor formed study commissions in 2011 and 2012 . The situation was very serious, but even after being presented with a litany of facts and figures, as well as the harsh testimony of the current and former Auditor Generals, only some of the suggested reforms were implemented.

That very modest effort to right the ship was inadequate, to say the least. Providence remains one of the worst funded plans in the country and is still officially in “critical status”. Over the last 10 months I have studied plans across the nation and according to the work of my Stanford Graduate School of Business team, it appears Providence city officials and their actuaries have been using questionable data in their analysis. Not only is the discount rate used for plan assets and liabilities inappropriately high, but plan assets have been overstated by at least $100 million.

Risks understated

Technically, actuaries are allowed to use smoothing methods for one more year, according to Government Accounting Standards. But given Providence critical status, asset smoothing was completely inappropriate.

Actuaries calculating pension liabilities behave much like Credit Ratings Agencies, who famously understated the risk of Wall Street’s bundled financial products.That behavior led to a disaster. Pre the Taveras reforms of last year and under the previous Mayor, Providence’s Unfunded Actuarial Liabilities were stated as $903,000,000 and then according to official City reports, after-Taveras reforms, the UAAL was reduced to $739,000,000.

Progress?

Not so fast!

The purposeful overstatement of plan assets is particularly revealing given the ease of obtaining the real time actual figures. Any adviser can with 99% accuracy, produce a daily figure.

I am in the business, so I know.

Selection of an appropriate discount rate was a huge subject in our Stanford course and on our team. When appropriately adjusted, Providence’s real liability appears to have been understated by over $600 million. An accurate UAAL is $1.35 billion., which is significantly worse than the Category 5 pre-reform figure of $903 million that spurred the latest reforms. The picture gets worse by appropriately adding the OPEB liability of $1.5 billion to pension liability. Providence has a $2.85 billion dollar problem.

The annual minimum required contributions, or ARC, for pensions and OPEB add up to approximately $170 million , leaving only $160 million in tax revenue to spend on running the city. This precarious situation is after the negotiated elimination of 6% colas and includes all the recent hard fought reforms. These changes are too little too late and the road to receivership may be extremely short. My early analysis using the same template shows West Warwick and Coventry are even worse and in my opinion both will be in receivership by year-end.

More urgency and significantly stronger actions are necessary. My intention is to take a deep dive into every town and explore all the facts as well as the causes and potential solutions. Next up, West Warwick.

"Michael G. Riley is vice chair at Rhode Island Center for Freedom and Prosperity, and is managing member and founder of Coastal Management Group, LLC. Riley has 35 years of experience in the financial industry, having managed divisions of PaineWebber, LETCO, and TD Securities (TD Bank). He has been quoted in Barron’s, Wall Street Transcript, NY Post, and various other print media and also appeared on NBC news, Yahoo TV, and CNBC.

Related Slideshow: New England States With the Most State Debt

Related Articles

- See Which New England States Have the Most State Debt

- New Effort Underway to Tackle Student Loan Debt

- The Most Debt-Ridden Cities and Towns

- Rhode Island Has 5th Highest Student Loan Debt in Country

- A LIVELY EXPERIMENT Debt Deal Implications

- NEW: Whitehouse—Debt Vote ‘Difficult and Unpleasant’

- Donna Perry: New Session Will Focus on Old Debts

- Rhode Island State Debt Among Highest in US

- INVESTIGATION: RI Has Defaulted on Moral Obligation Debt Before

- Rhode Island Student Loan Debt 9th Highest in Country

- New Report: Rhode Island Gets C for Debt Protection

- Rhode Island is the 7th Most In-Debt State in America

- LISTEN: Most Debt-Ridden Cities and Towns + Hot or Not

- Which New England State Has the Most Debt?