Half of RI Taxpayers Lose out on Car Tax Money

Thursday, April 11, 2013

The current system of state aid tied to car taxes rewards communities with higher tax rates, punishes those with lower rates, and effectively forces nearly a half of all state taxpayers to subsidize the other half, says a prominent northern Rhode Island mayor.

“You have some taxpayers being treated differently than other taxpayers,” said Dan McKee, the mayor of Cumberland.

McKee says state aid for car tax revenue—often referred to as a reimbursement since it’s meant to compensate communities for the amount of revenue they lose through exemptions—is greater for those communities with higher tax rates.

GET THE LATEST BREAKING NEWS HERE -- SIGN UP FOR GOLOCAL FREE DAILY EBLASTThe upshot is that communities like Cumberland end up subsidizing cities like Providence and Pawtucket, according to McKee.

He says using tax rates as a basis for doling out state aid is arbitrary and unfair. Instead, McKee says that a fair system would base state aid on the ratio of the total value of all motor vehicles in a city or town to the total valuation for the entire state. For example, if a ten percent of all vehicle values were located in particular city or town, that community should receive ten percent of all state aid issued that year for car tax reimbursements.

McKee says his proposal is based on the same basic principle behind the new state education funding formula, which recently has been reformed so that state funding is tied to the number of students in a community. “If it’s good for one policy, it should be good for another policy,” McKee said.

However, that formula also makes adjustments for communities that are poorer and may need more assistance from the state—something McKee said he is open to incorporating into his proposal.

Current state system accused of hurting suburbs

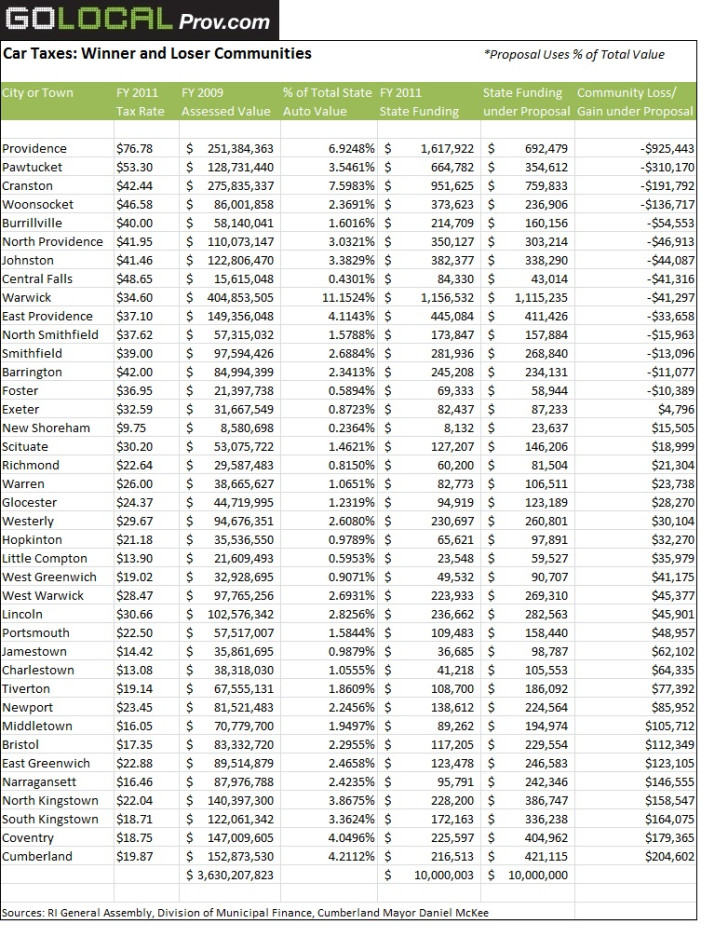

Under the current system of state aid, Cumberland benefits the least from state car tax aid, followed by Coventry, South Kingstown, and North Kingstown. The communities benefitting the most are Providence, Pawtucket, Cranston, and Woonsocket.

Over the past decade, McKee says Cumberland has lost out on $20 million in state aid that it would have otherwise received were the system fairer. That creates pressure to keep tax rates higher than they should be and limits his administration’s ability to provide as much funding as it wants for work on local infrastructure, McKee said.

Using McKee’s standard for fairness, about two thirds of cities and towns—accounting for about 400,000 residents—lose out in the current system of state aid. Because taxpayers in those communities are receiving less than what they should be, McKee says they are effectively subsidizing the communities that are receiving more in state aid.

McKee’s proposal would radically shift the current system of how the state provides funding to communities for car tax revenues.

It would pour an additional $204,602 of state aid into Cumberland’s coffers and between $158,547 and $179,365 for the other three communities most disadvantaged under the current system. But, it would also cut nearly $1 million in state aid from Providence and about $300,000 from Pawtucket—using 2011 figures for state aid allocation, which totaled $10 million statewide that year. (See below table for a comparison of all 39 cities and towns based on the current system and the proposed reform.)

And that makes his idea a huge sticking point with officials from those cities.

“Any further reduction in [state] aid is going to put some communities in perilous financial condition ever closer to the edge,” said Daniel Beardsley, executive director of the Rhode Island League of Cities and Towns. Because his membership is divided over the issue, he said the league remains neutral on the best system for the allocation of state aid for car tax revenues.

Cities strongly oppose proposal

But officials in the communities that would lose out under the McKee proposal staunchly oppose the idea.

“As mayor of Pawtucket and thus a board member of the League of Cities and Towns, this is the first time I have heard about this proposal,” Pawtucket Mayor Don Grebien said in a statement released to GoLocalProv last night. “I’m surprised and disappointed to learn that as a community Pawtucket would be hurt by such a proposal, and wish Mayor McKee had reached out to me directly prior to any such announcement.”

“I will be sure to reach out to him over the coming weeks to get a better understanding of exactly what his proposal would entail and its potential financial impact on Pawtucket,” Grebien added. “My administration will continue to work hard to move Pawtucket to a better financial position. I will not allow the hard-working residents of Pawtucket to be hurt by any such proposal or decision that would appear to have such a negative financial effect on our city.”

In Providence, city Councilman Bryan Principe said he appreciated the effort to provide tax relief but faulted McKee’s plan for not taking into account poverty. He said it only stands to reason that poorer communities would have a lower per capita car value than wealthier ones.

“I don’t think it’s fair to distribute the allocation of state aid based upon the municipality’s share of vehicle [valuation],” Principe said.

He said that a $500 clunker of a car and a $50,000 Mercedes both cause the same wear and tear on roads, making vehicle values a less relevant basis for deciding how much money cities like Providence would need to repair and rebuild their roads. If there has to be some variation in how state aid is distributed, Principe said it would be better to base it on the number of vehicles or the amount of traffic on a community’s roads.

(Principe added that he isn’t convinced that there needs to be such wide variations in state aid. He personally favors the institution of a universal motor vehicle tax rate in Rhode Island, modeled on Massachusetts. Yesterday, city Councilwoman Sabina Matos said she supported the same approach.)

But McKee’s ideas won support from other quarters yesterday, including the town manager for South Kingstown, Stephen Alfred, who agreed the current system is unfair. “The distribution has been out of balance ever since the year the tax rates were frozen,” Alfred said.

He said income and sales taxes on South Kingstown residents are viewed locally as going to Providence with “very little” coming back. He agreed that McKee’s proposal was fairer. (Another supporter is Cumberland state Rep Karen MacBeth.)

Debate over fairness echoes national one

But how to define what is fair is a matter of some debate. Tony Pires, the director of administration in Pawtucket, said that on a national level fairness has been defined as the ability to pay—meaning that those who can afford to pay higher taxes should, instead of adding to the burden of taxpayers with lower incomes who are already taxed to maximum, as is the case in Pawtucket, Pires said.

“That really ought to be the standard by which any of these suggestions ought to be judged,” Pires said.

He said the amount of state aid Pawtucket would lose under the McKee scenario—about $300,000—translates into about a dime on the local tax rate. “We’d have to find another $300,000 in savings or pass that burden onto taxpayers,” Pires said.

Cities like Providence and Pawtucket, he added, have a “greater expenditure responsibility” because of crime rates, fire protection needs, and schools where more spending is needed because of the socioeconomic background of their students.

He also contested the idea that principle behind the state system is unfair. Pires is the former House Finance Chairman and was in office when the current system of aid was developed. He said the original idea was simply to reimburse communities for the amount of revenue they would lose by exempting some of the value of vehicles—which at one time was $6,000 before the recession led cash-starved state officials to drop the threshold to $500.

Pires said allocating state funding the way McKee advocates would unduly cost a city like Providence revenue and enrich a community like Cumberland—providing it with more of a reimbursement for lost revenue than it needed.

And, if anything, he said Pawtucket loses more under the current system of state aid than Cumberland actually does. In theory, state aid is supposed to reimburse cities and towns for the amount of revenue they lose by exempting some of the vehicles of a car. The current exemption amount for which the state will make up the difference is $500.

Based on those figures, Pires said Pawtucket should be getting $2.5 million in state aid. But instead it received about $664,000 in 2011—about 20 percent of what it should have. Of course, Cumberland also received only 20 percent of its reimbursement as well, but Pires said the difference in dollars was much greater for Pawtucket than it was for Cumberland.

Asked if he could understand the car tax frustrations of communities like Cumberland, Pires responded: “We only ask that they walk in our shoes.”

Stephen Beale can be reached at [email protected]. Follow him on Twitter @bealenews

Related Articles

- LISTEN: Highest Car Taxes in RI

- Pawtucket Investigating Lincoln Fire Chief for Avoiding Car Taxes

- The Highest Car Taxes In Rhode Island

- The Highest Car Taxes in RI for 2013

- Dozens Protest Providence Car Taxes